The development and progress of renewables is at the very core of the deployment of large-scale green hydrogen. Renewable energy is a huge cost in green hydrogen projects and production. Increase in efficiency and reduction in costs for renewable energy technologies will play a huge role in making green hydrogen competitive. The REN21 Global Status Report 2024 is presenting a sobering analysis of where we currently stand in the fight against climate change. Despite significant strides in technology, investments, and policy commitments, the pace of transition is not yet aligned with the ambitious goals set by international agreements, such as the Paris Agreement. The report clearly indicates that although momentum behind renewable energy is strong, critical gaps remain that must be bridged to secure a sustainable, low-carbon future.

In response to increasing pressure from investors, regulators, and the public, many oil and gas companies have started to invest in renewable energy. In 2023, oil and gas majors allocated around USD 17 billion to renewable energy projects. While this represents a small fraction of their overall capital expenditure, it marks a significant shift in strategy as these companies seek to diversify their portfolios and reduce their carbon footprints. Still, the scale of investment by oil and gas companies in renewables remains modest compared to the continued investment in fossil fuel exploration and production.

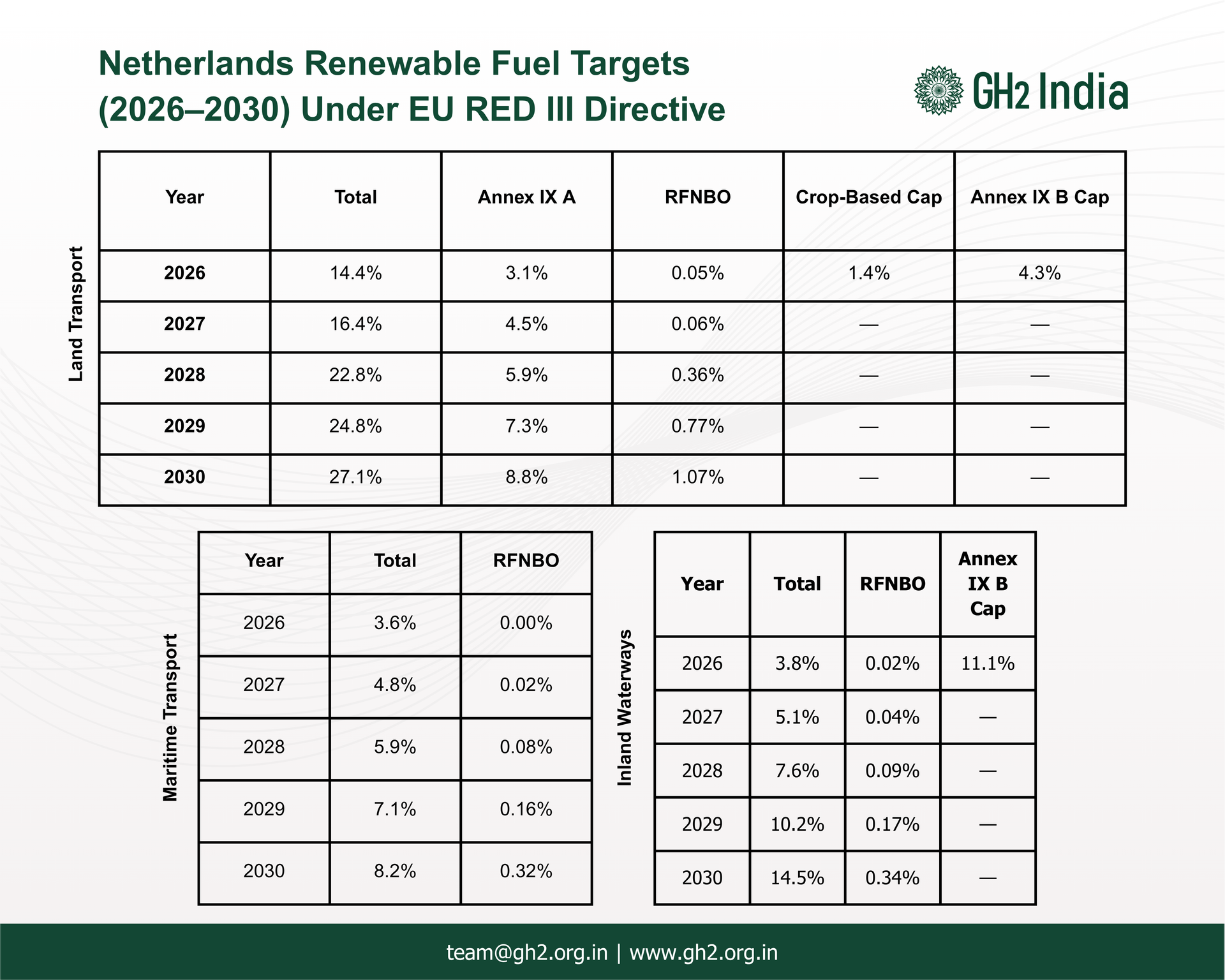

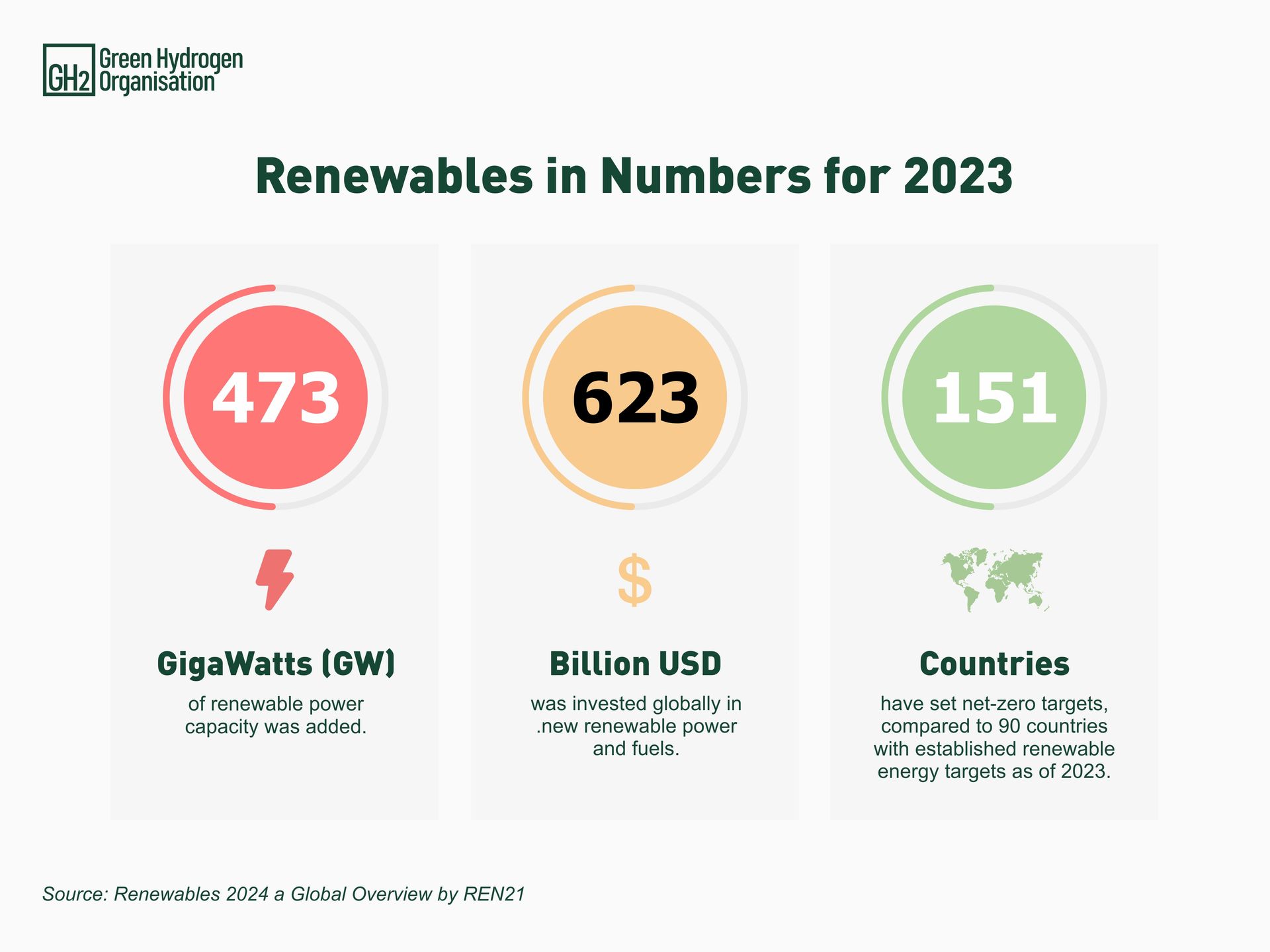

On the policy front, while 151 countries have set net-zero targets and 90 countries are implementing nationwide renewable energy targets, the gap between policy ambitions and on-the-ground implementation remains significant. For example, the European Union has set ambitious targets for renewable energy in its energy mix by 2030, but achieving these targets requires substantial policy reform, infrastructure investment, and technological development. Currently, only China is on track to meet its renewable energy target of 28% by 2030. Renewable hydrogen gained policy attention during 2023, with 41 countries having in place a renewable hydrogen strategy or roadmap by year’s end. Despite rising policy attention, renewable hydrogen deployment has lagged globally due to high production costs and weak demand.

Trade tensions and protectionist policies are also becoming significant hurdles in the global trade landscape for renewable energy. For instance, tariffs on solar panels imported from China by the United States have affected the global supply chain, raising costs for solar energy projects. Similarly, the European Union's efforts to boost local production of renewable energy technologies could lead to trade disputes and disrupt the global market.

In sectors like agriculture, transport, buildings, and industry, the integration of renewable energy remains slow. Agriculture, responsible for 20-30% of global greenhouse gas emissions, has only seen limited adoption of renewable sources. The transport sector, which accounts for 24% of global emissions, is gradually transitioning to electric vehicles, but the shift is uneven across regions. Industrial decarbonization remains a significant challenge, with global investments in industrial energy efficiency amounting to USD 80 billion in 2023, but gaps in the adoption of best practices and technologies persist.

Electricity generation is one area where substantial progress has been made, with renewable energy capacity additions reaching a record 473 GW in 2023. However, fossil fuels still account for over 60% of global electricity generation, posing a major barrier to meeting global climate targets. Even in countries like China, which leads in renewable energy capacity, there is a tension between economic growth and environmental sustainability, as evidenced by the approval of 114 GW of new coal power capacity in 2023.

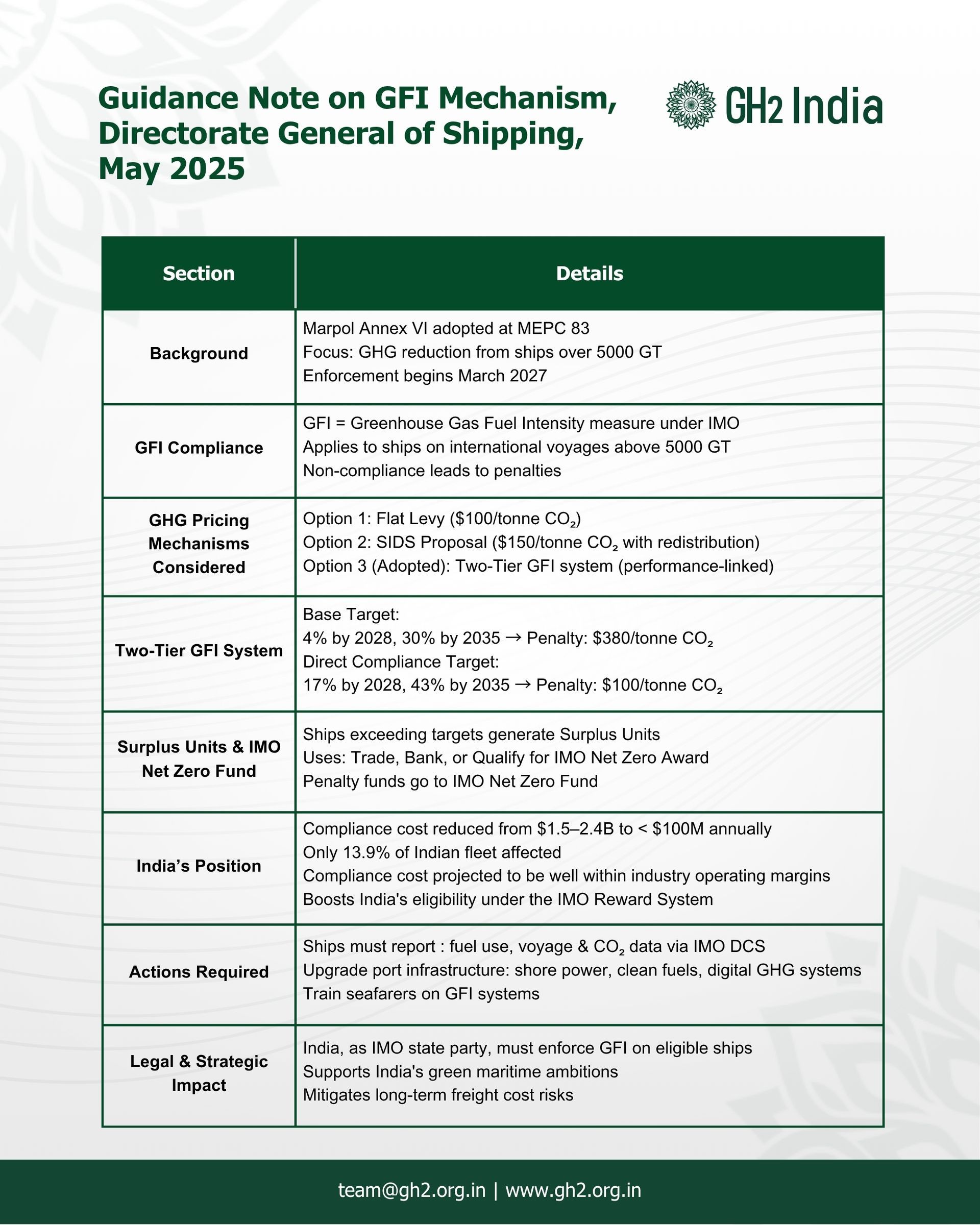

Carbon pricing is another critical policy tool for reducing emissions and driving the transition to renewable energy. However, the effectiveness of carbon pricing mechanisms varies widely, with many prices set too low to incentivize significant emissions reductions. While the European Union’s Emissions Trading System (ETS) provides a strong signal for emission reductions, other regions have set carbon prices that are insufficient to drive meaningful change. There is also an increasing popularity of green bonds as a tool for financing renewable energy projects. In 2023, global green bond issuance reached an all-time high of USD 580 billion, with a significant portion allocated to renewable energy and energy efficiency projects. However, issues like “greenwashing” remain a concern, where projects are marketed as environmentally friendly without substantial evidence, leading to calls for stricter standards and better reporting mechanisms.

The report also highlights the often-overlooked role of renewable heat supply, which accounts for about 50% of global final energy consumption. Despite its importance, policies to promote renewable heat are lagging, and fossil fuels continue to dominate this sector. The global renewable heat capacity increased by about 5% in 2023, but this still represents only a small fraction of the total heat supply, indicating a need for stronger policy support and greater investment in technologies such as geothermal, biomass, and heat pumps.

The global renewable energy transition is an enormous undertaking that requires unprecedented levels of coordination, investment, and political will. While progress has been made, significant gaps remain that must be addressed to meet the climate goals and other international commitments.

Read the full report here : https://www.ren21.net/gsr-2024/

Investments is a critical area where more is required. The global investment in renewable energy reached USD 622.5 billion in 2023, from USD 576 billion in 2022. However, approximately USD 1,300-1,350 billion needed annually by 2030 to meet the Paris Agreement's targets. This gap is alarming, given the urgent need to expand renewable energy capacity, modernize energy grids, and integrate advanced technologies like energy storage and renewable hydrogen. The uneven distribution of this investment, with much of it concentrated in a few regions, further exacerbates the challenge, particularly for developing countries that struggle to attract the necessary capital.

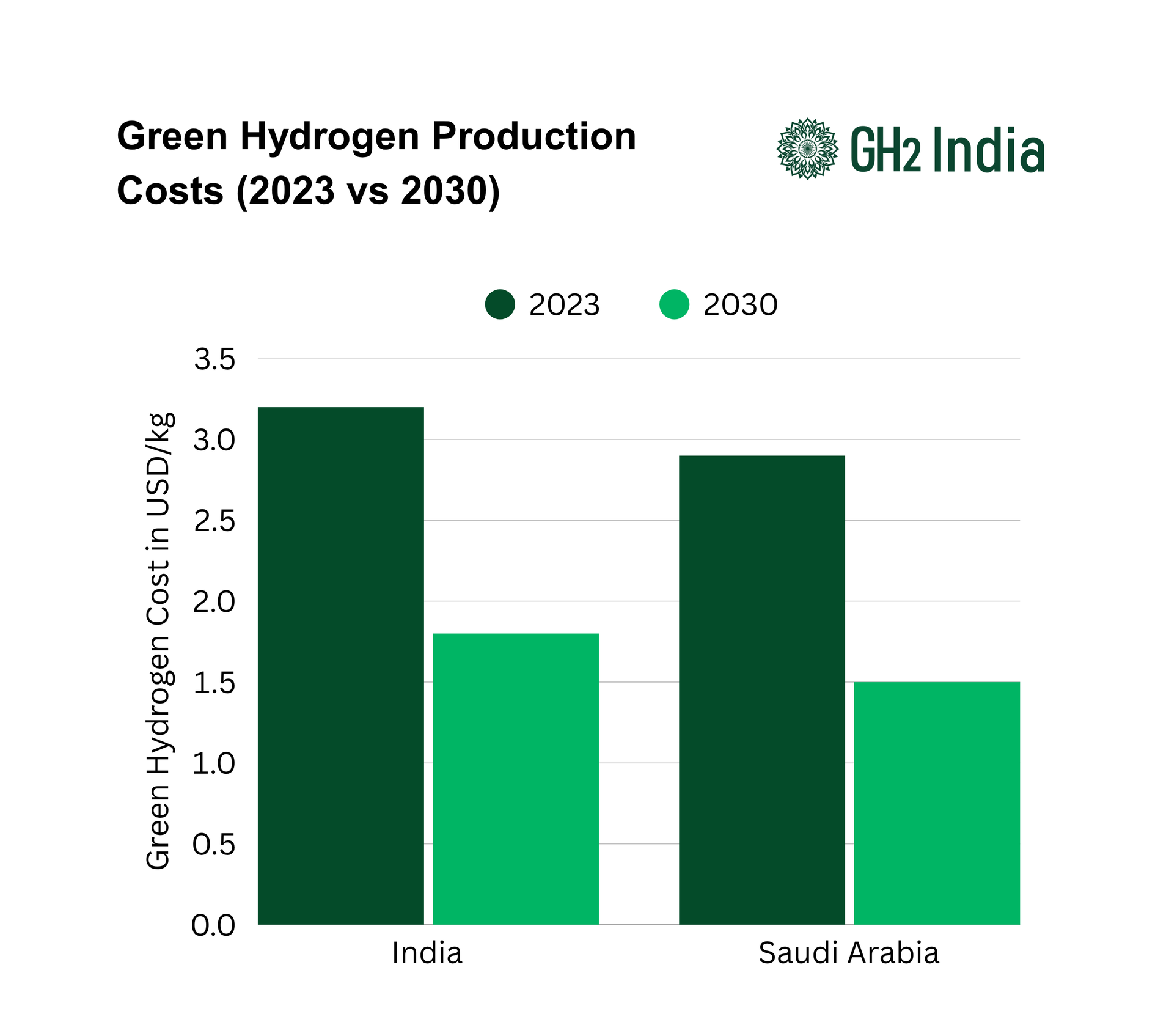

The financial pressures on the renewable sector are compounded by rising costs. These increases have led to the cancellation or delay of several projects, highlighting the delicate balance between ambition and affordability. The growing demand for critical minerals, essential for renewable technologies, has also triggered concerns about supply shortages, price volatility, and environmental degradation. The price of these minerals surged by over 30% in 2022, further straining the sector. The cost of renewable hydrogen has increased by higher labour and material costs, increase in the cost of capital of 3-5% and prices for renewable power.

Despite the rapid growth of renewable energy, fossil fuels continue to dominate the global energy mix, hampering efforts to reduce emissions. In 2022, global energy-related CO2 emissions rose by 1.1%, reaching 37.5 billion tonnes. Although renewable energy accounted for 86% of new power capacity additions in 2023, the overall transition is not happening fast enough to meet growing energy demands and reduce emissions. Modern renewables still represent only 13% of the global total final energy consumption (TFEC), indicating that much more needs to be done.

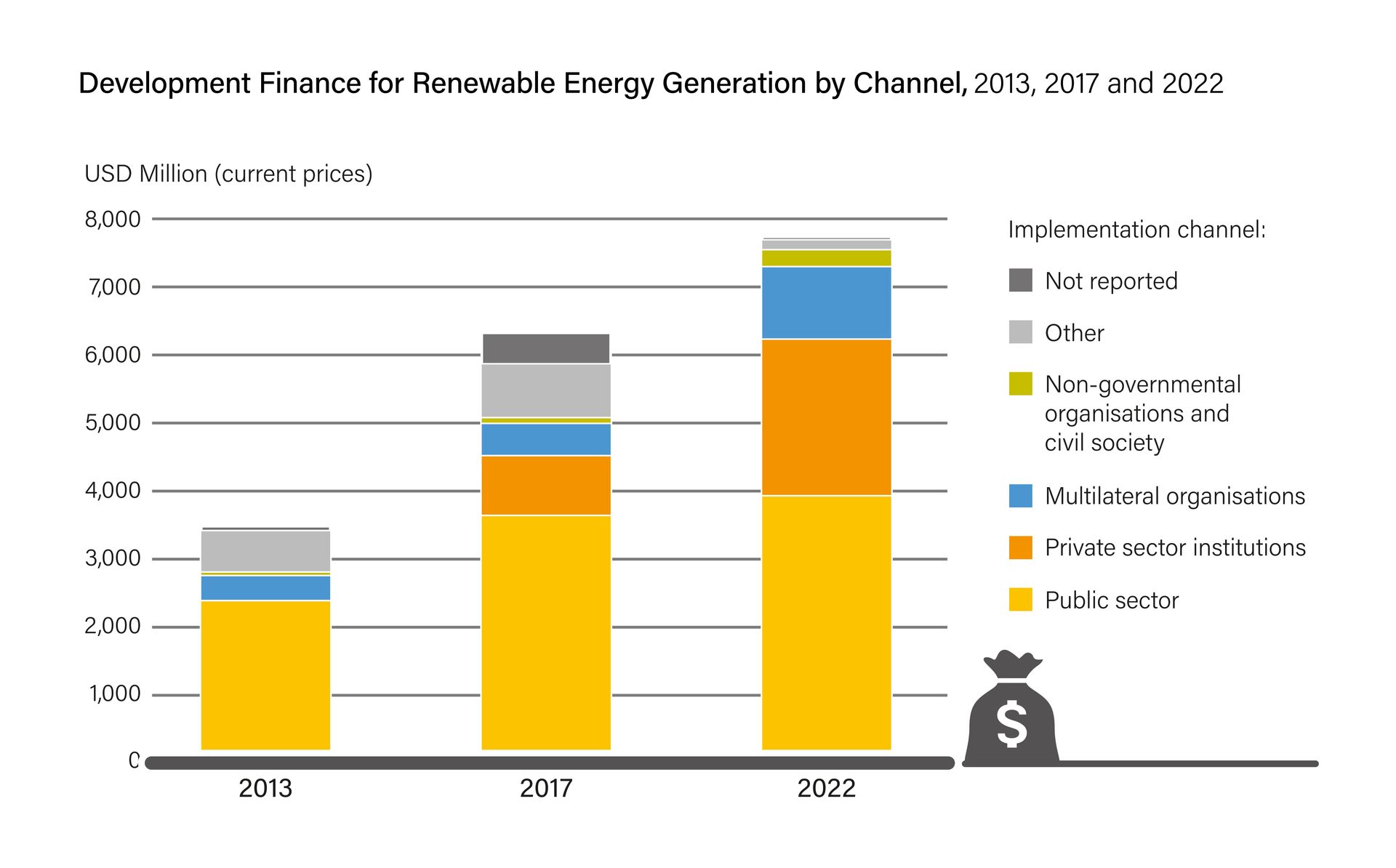

Development finance plays huge role in supporting renewable energy, especially in low-income countries where access to energy remains a significant challenge. Yet, the report highlights that development finance for renewable energy is insufficient and unevenly distributed. While finance for renewable generation projects globally has more than doubled from USD 3.5 billion in 2013 to USD 7.85 billion in 2022, the bulk of this is in the form of loans or equity investments, with grants representing only 35% of total government-driven assistance. Moreover, despite multilateral development banks adopting policies that exclude support for fossil fuels, fossil gas remains an aid recipient, with USD 1.9 (20%) billion disbursed for non-renewable energy projects in 2022.