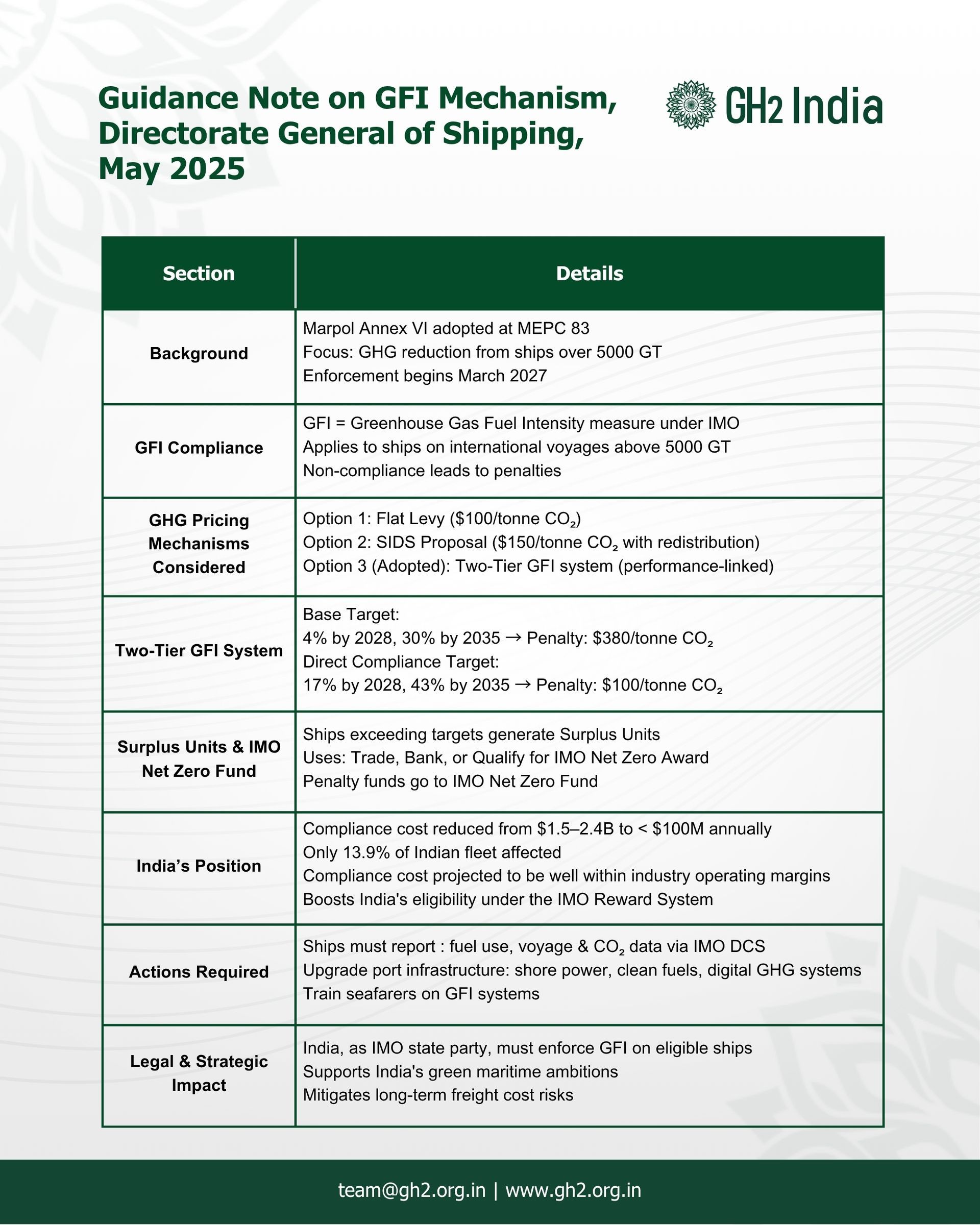

Earlier this May, the Directorate General of Shipping released a guidance note to carve out a roadmap for India to comply with Marpol Annex VI adopted this year at MEPC 83. This note explains the key provisions of Marpol Annex VI and aims to build preparedness among the Indian Shipping industry with respect to the upcoming regulations under IMO’s framework.

- GFI Compliance

- Adopted at MEPC 83, the Greenhouse Gas Fuel Intensity (GFI) measure is a mechanism to progressively reduce greenhouse gas emissions from ships above 5000 GT. Marpol Annex VI has set specific GFI limits which ships on international voyages must follow or face penalties. The GFI is set to come into force in March 2027.

- Having considered the three different methods under the GHG pricing mechanism, including a flat levy where ships will be uniformly penalised at $100 per tonne of CO2 emitted; a higher penalty of $150 per tonne of CO2 emitted but the penalty redistributed among different sectors for climate vulnerable countries through the Small Island Developing States (SIDS) proposal; and, the Two-tier GFI mechanism which is a performance linked system penalising ships with high GFIs while rewarding those with GFI below the target levels, the later was adopted through a majority vote at the MEPC 83.

- The two tier GFI mechanism entails, eligible ships to abide by two levels of targets; a) A Base Target which aims for decarbonisation at 4% by 2028 and 30% by 2035 and b) The Direct Compliance Target aiming at decarbonisation at 17% by 2028 and 43% by 2035. This mechanism levies penalties in the form of ‘remedial units’ for failure to meet the targets. For failing to meet the base target, a higher remedial unit purchase worth $380 per tonne of CO2 is set out while a failure to meet the direct compliance target, ships must purchase remedial units worth $100 per tonne of CO2.

- Ships which surpass these targets can also generate ‘Surplus Units’, which can be used to trade with other ships in lieu of other benefits; or banked for future use; or even used to qualify for the IMO Net Zero Award.

- The GFI mechanism also lays down a plan for redistribution of the funds generated through the penalties. These will be held under the IMO Net Zero Fund which can be encashed for financial incentives to well performing ships, assist developing countries in their climate initiatives etc.

- India’s Position

The Note elaborates on India’s position on the GFI mechanism :

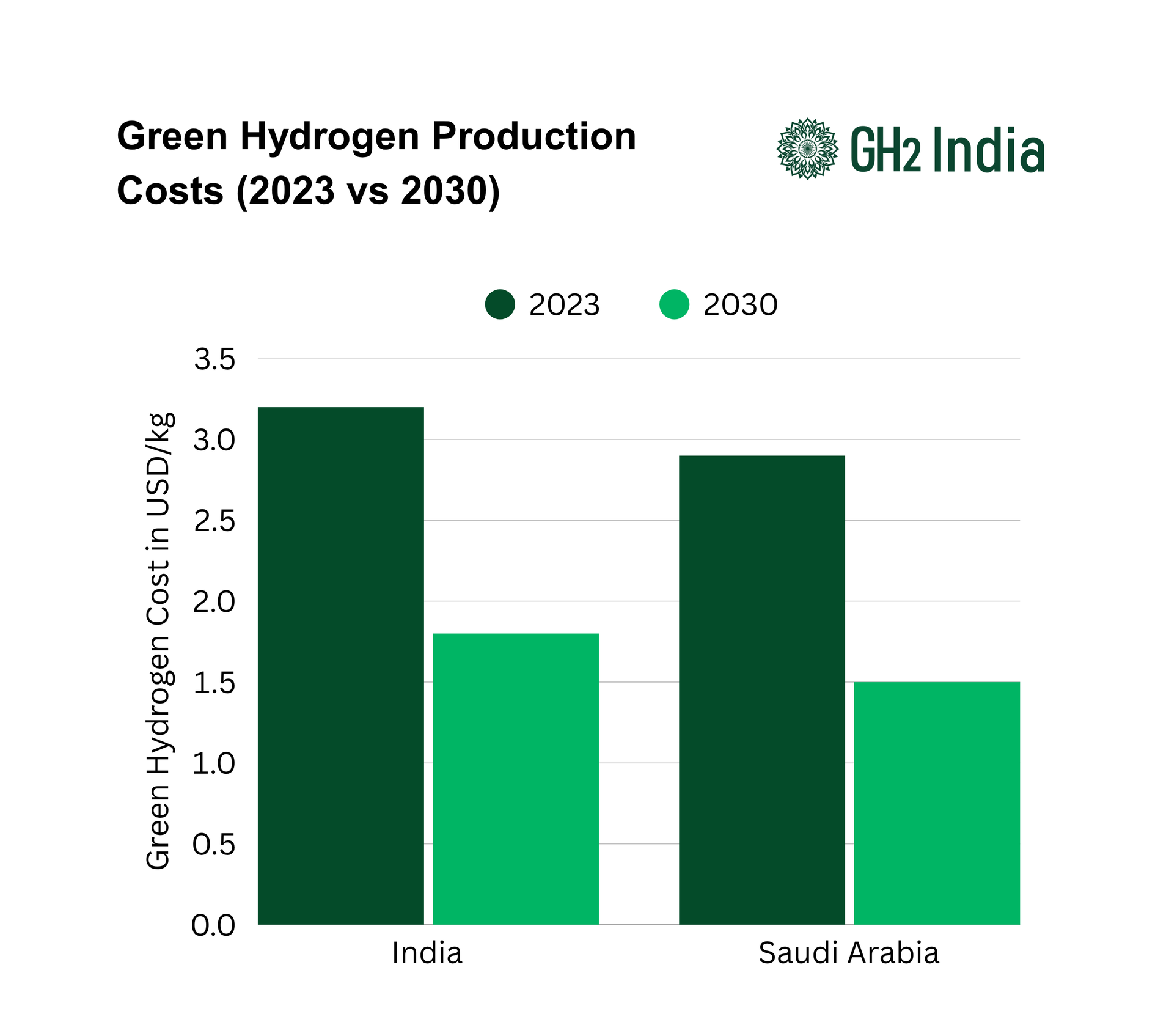

- The flexible pricing mechanism under GFI benefitted India by firstly, reducing the cost impact from $1.5- $2.4 billion annually to under $100 million, compared to a flat levy structure. It incentivises adoption of clean technologies while being well aligned with India’s climate transition strategies.

- The GFI mechanism however does not impact Indian fleet much. Only 13.9% of Indian ships come under the purview of the GFI mechanism.

- The GFI mechanism is expected to increase India’s compliance cost by $ 87–100 million annually by 2030 which is well within the industry operating margins.

- This also promotes synchronisation of India’s projected production capacity of green ammonia and methanol by 2030 with the eligibility criteria of the IMO GFI reward system. This will also boost India’s export potential and investment in clean energy.

- Action Needed

- Ships which are eligible under the IMO framework must annually report fuel consumption, voyage data, and carbon intensity metrics through the standardized IMO Data Collection Systems.

- Aligning ports infrastructure through improved shore power, digital GHG inspection systems, and clean fuel availability to the GFI system will amplify Indian ports’ position as a green bunkering hub.

- Indian seafarers must have their capacities and awareness built on operational knowledge of GFI reporting, fuel lifecycle characteristics, remedial unit tracking, and voyage planning for emission optimization

- Indian ships involved in international trade must factor GHG compliance in order to reduce long-term freight inflation risks.

While India retains the sovereign right over the enforcement of Marpol Annex VI, as a state party of IMO, it will be under the legal obligation to ensure the eligible ships remain compliant with GFI mechanisms. This will also be advantageous for India from a fiscal standpoint and reinforce India’s influence in shaping global governance of the green shipping landscape.