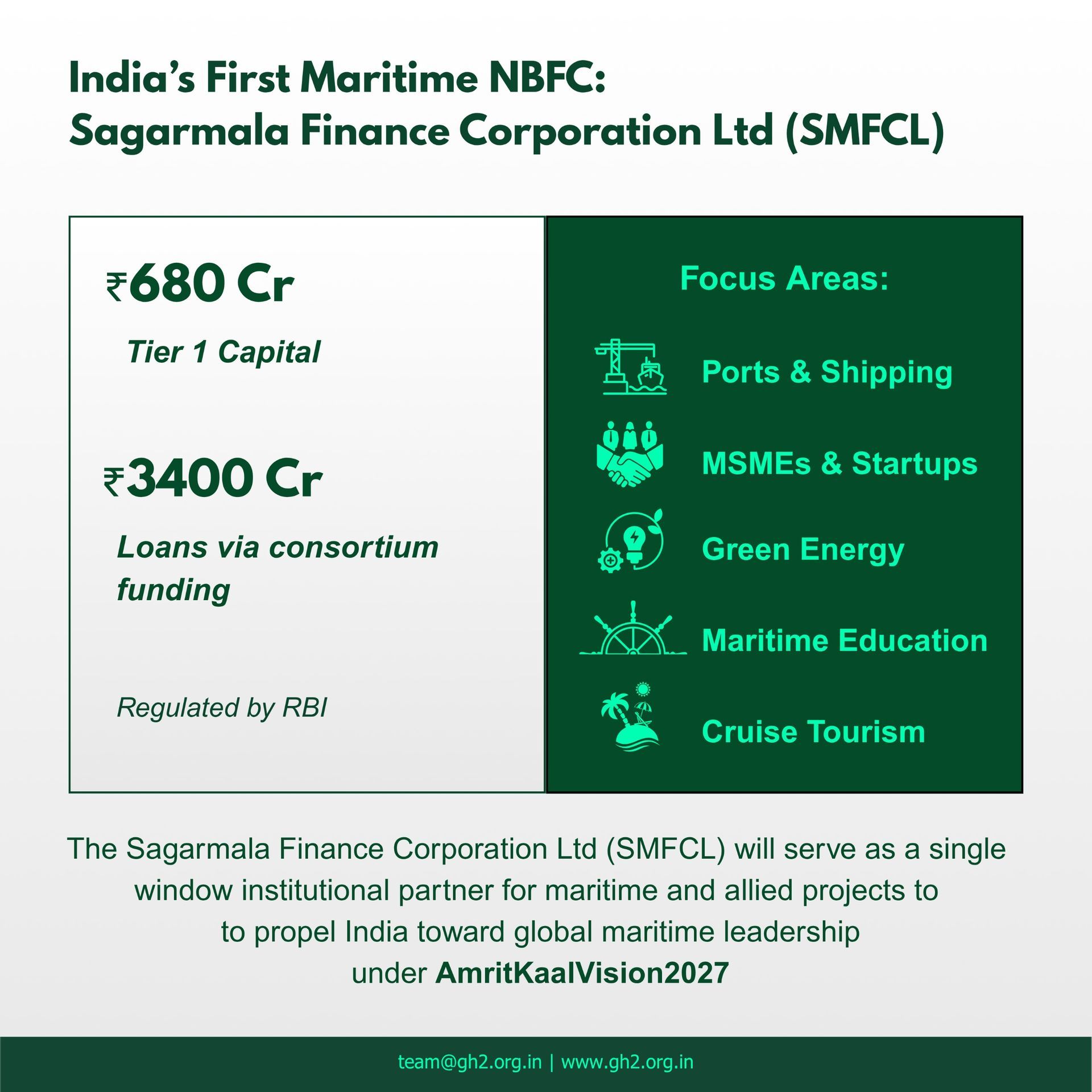

Last week the Hon’ble Union Minister of Ports, Shipping and Waterways, Shri Sarbananda Sonowal unveiled the Sagarmala Finance Corporation Limited (SMFCL), the first of its kind Non-Banking Financial Company (NBFC) exclusively for the maritime sector. In its previous avatar as the Sagarmala Development Company Limited, SMFCL was the key implementing entity for the Sagarmala Programme, encompassing project development and formulation to fund raising and Coastal Economic Zones master plan, among others.

This remodelling comes as a response to the long-standing demand of the maritime industry for a sector specific financing institution and is in alignment with India’s goal to emerge as a global maritime leader under the Amrit Kaal Vision 2027.

On account of the maritime industry being a capital-intensive sector which is slow to yield returns with regulatory strictures, investment prospects are often limited. This risky and yet niche sector struggled to procure private lending from banks and private investors and thus the need for a unified financial institution dedicated just to the marine industry was reinforced.

On June 19, 2025 SMFCL was formally registered as an NFBC with the Reserve Bank of India (RBI) and is categorised as a Mini Ratna, Category I, Central Public Sector Enterprise. With the Tier 1 capital estimated at Rs 680 crore, SMFCL has the capacity to offer bigger loans with consortium partners, valuing up to Rs 3400 crores.

With the objective of bridging the financial gaps in the maritime industry, SFMCL will provide financial support towards empowering ports, MSMEs, startups, and maritime educational institutions. As a dedicated financing body, SFMCL is poised to usher in significant transformation in the maritime sector and accelerate industry wide growth, sustainability and innovation.

It will also extend to strategic sectors like shipbuilding, renewable energy, cruise tourism, and maritime education. Overall, by enabling access to a focused financial opportunity, SFMCL will leverage efficiencies and inclusive development in the maritime sector, thus propelling India towards global maritime leadership.

Built akin to other successful development financial institutions in India like the Indian Railway Finance Corporation for the railways, SMFCL comes with an expanded funding horizon and several other essential services. These include blended finance instruments like equity, subordinated debts, debts etc. It will also support Private Public Partnerships (PPPs) in financing logistics corridor, coastal infrastructure among others.

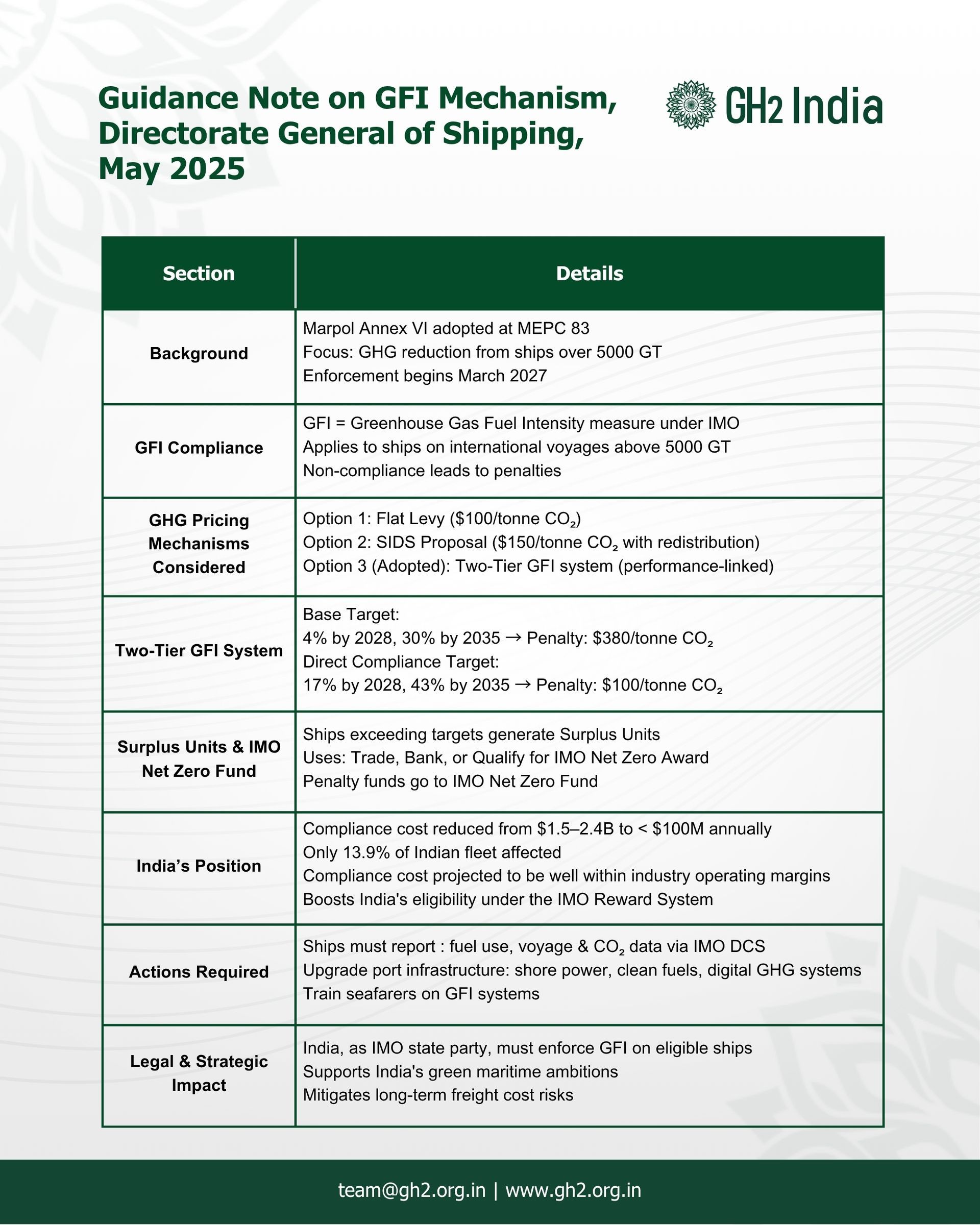

SMFCL’s founding is a critical step towards steering India’s maritime sector at par with the global standards. The European Commission launched the Ship Financing Portal in July 2024, serving as a centralized repository of financing products for the EU-based maritime sector. This is complemented by European Investment Bank’s (EIB) co-financing maritime sector project. Similarly, in Japan, the SMBC Group operates a global maritime finance division, leveraging its strong balance sheet and institutional dedication to the shipping industry to provide long-term support.

SMFCL is not only likely to help the maritime industry overcome the financial bottlenecks but also will greatly boost the green transition in the maritime industry, as envisioned in India ’Gateway to Green roadmap. Streamlined funding will help amplify green hydrogen capacity at ports and bunkering stations, and enable shore power infrastructure, etc. This brings in the much-needed transformation to the erstwhile fragmented investment space for the maritime industry and enables SMFCL to cater to the unique capital requirements of the maritime and shipping sector.